Secure Your Financial Investment With Flexible Hard Money Finances

In today's busy property market, securing your financial investment requires a tactical approach to funding. Adaptable difficult money financings use an engaging alternative to conventional loaning, focusing on the worth of the residential property over the consumer's credit scores history. This versatility not just enhances the authorization procedure yet also opens up doors for a broader variety of financiers. As we explore the subtleties of tough cash fundings, including their advantages and application processes, it comes to be clear that understanding these funding alternatives might substantially impact your financial investment technique. What considerations should you remember as you browse this landscape?

What Are Hard Cash Fundings?

When checking out funding choices, lots of individuals come across tough money lendings, which are short-term fundings protected by actual residential property. Largely utilized in property transactions, difficult cash loans are generally issued by private investors or firms instead of conventional financial organizations. These fundings are usually sought by consumers who call for quick accessibility to capital, such as genuine estate capitalists looking to buy, remodel, or flip residential or commercial properties.

Hard cash car loans are characterized by their expedited approval processes and much less rigorous qualification requirements compared to standard car loans. Rather than concentrating mostly on a consumer's credit reliability, loan providers assess the hidden worth of the residential or commercial property being used as collateral. This strategy permits faster purchases, making tough cash financings an enticing choice in competitive property markets.

Benefits of Flexible Financing

Versatile financing alternatives, particularly in the world of tough money loans, provide countless benefits to customers browsing the vibrant actual estate market. Among the most considerable benefits is the speed of funding. Traditional lendings frequently include extensive approval procedures, whereas difficult money financings can be secured swiftly, permitting capitalists to confiscate time-sensitive chances.

Moreover, flexible funding fits different kinds of homes and investment strategies. Borrowers can utilize these finances for fix-and-flip projects, rental residential properties, or also business endeavors, thus expanding their investment perspectives. This versatility is particularly useful in a fluctuating market where standard lending institutions may enforce rigid criteria.

In addition, hard money car loans typically come with much less rigid credit score demands. Financiers who may struggle to receive conventional financing because of previous credit problems still have the opportunity to safeguard financing, empowering them to pursue their financial investment objectives.

Just How to Get approved for a Funding

Receiving a difficult money car loan includes numerous vital factors that prospective borrowers need to comprehend to enhance the application process. Unlike traditional financings, difficult cash lenders focus mainly on the value of the property being used as collateral instead of the customer's credit rating or revenue. Thus, a detailed assessment of the residential or commercial property is necessary to determine its market worth, which significantly affects the funding quantity.

Prospective borrowers try this web-site should likewise show a clear understanding of their investment method, showcasing how they prepare to use the funds and the capacity for home admiration. Lenders normally require a deposit, varying from 20% to 40%, reflecting their interest in minimizing risk.

Additionally, the customer's experience with genuine estate financial investments can play an essential function in the credentials procedure. A tried and tested record can boost reliability and boost the opportunities of safeguarding desirable terms. Having a well-prepared leave strategy, outlining exactly how the funding will be paid back, is essential. By dealing with these variables, borrowers can considerably enhance their opportunities of getting a hard cash financing, assisting in a smoother funding experience for their investments. hard money loans georgia.

The Application Refine Discussed

The application procedure for a tough money funding is simple yet calls for cautious prep work and documents. Typically, the primary step involves identifying a dependable hard money lender who focuses on your kind of financial investment. As soon as you have actually picked a lending institution, you will require to submit an application that includes essential personal info and details about the residential property you intend to buy or refinance.

Following, the loan provider will carry out an initial assessment of the property's value, commonly depending on a recent appraisal or equivalent sales data. This evaluation is critical, as difficult cash finances are like it mostly based on the residential or commercial property's equity as opposed to the debtor's creditworthiness.

After the initial review, the lending institution might request added documents, such as evidence of income, investment history, and a comprehensive job strategy if remodellings are involved.

As soon as all needed details is offered, the lender will assess your application and determine the financing amount, rate of interest, and terms. If approved, the last step involves finalizing funding papers and completing the financing process, allowing you to secure your financial investment properly.

Tips for Maximizing Your Financial Investment

Safeguarding a hard money finance is just the beginning of your financial investment journey; maximizing your financial investment needs critical planning and execution. To attain this, start with detailed market research. Evaluate patterns, residential property worths, and community dynamics to determine profitable chances. Recognizing the local market will allow you to make enlightened decisions and improve your financial investment's possible return.

Following, take into consideration the timing of your investment. Additionally, emphasis on building enhancements that yield the highest possible return on financial investment (ROI)

Additionally, keep a solid financial plan. Keep track of all costs and earnings associated to your financial investment to ensure you remain within budget plan. This monetary discipline helps prevent unexpected costs that can deteriorate your profits.

Verdict

In final thought, adaptable tough money lendings offer as an essential financial tool for genuine estate investors seeking quick access to funding. Eventually, leveraging difficult cash lendings can considerably Learn More enhance investment capacity and maximize returns in an affordable actual estate landscape.

Nancy McKeon Then & Now!

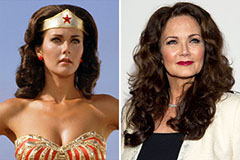

Nancy McKeon Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Kane Then & Now!

Kane Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!